The Silicon Valley is experiencing a housing crisis of epic proportions. It's a place with many more jobs than housing which results in an increase in the already high cost of living, pushing people who cannot afford to live within the city to move to other cities and commute to get to work. As the economy and housing prices continue to be driven up, a term known as the housing market bubbles grows.

What is the Housing Market Bubble?

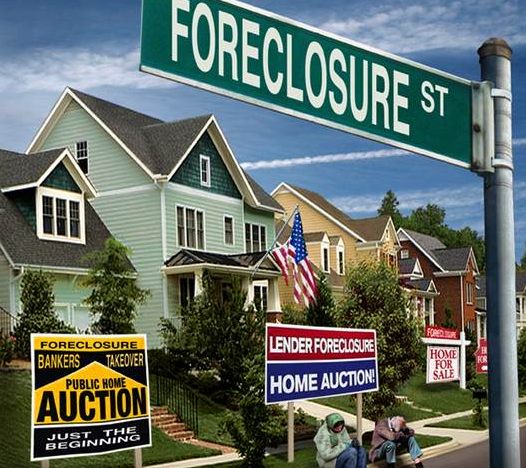

The housing market bubble is a run-up in housing prices fueled by demand, speculation, and exuberance. They tend to start with an increase in demand while there is a limited supply which takes a relatively long period to replenish/increase. Multiple buyers and speculators enter the market which drive up the demand even further, however at some point the demand decreases/stagnates at the same time supply increases which results in a sharp drop in prices and thus bursting the bubble. Basically to reiterate, the housing bubble is a result of supply and demand. When supply is low and demand is high, the bubble grows resulting in higher prices. The bubble bursts/pops once supply is high and demand is lower, resulting in sharp drops in pricing of the supply.

Causes of a Housing Bubble

Housing markets tend not to be highly prone to bubbles due to the large transaction and carrying costs associated with owning a house, however a combination of low interest rates and a loosening of credit standards can result in money borrowers that come into the market and fuel demand. On the other hand, a rise in interest rates and a tightening of credit standards can reduce the demand and pressure those who have been lent out money, potentially resulting in a housing bubble burst. Basically, when people are able to get access to more money (which typically happens through bank loans), they are prone to go into the housing market to buy a house. If most people are able to get the loan and enter the market, the demand for houses goes up and as a result the price of each house increases as well. This brings up the cost of living in an area as well as the price of houses. Once banks bump back up their interest rates and demand their money back, demand quickly drops resulting in sharp/large price drops and thus is considered to be the housing bubble bursting.

The Future & Protecting Yourself

Many economists are warning of a potential crash in the nearby future, and many of them believe that the crash will be most likely to happen in 2020 after the presidential election. In order to improve your chances of not defaulting to a mortage on your house, you should keep these things in consideration:

- Job Security: the more job security you have, the less likely you are to be jobless when the crash happens. This provides you with a source of income when the economy come crashing down, insuring that you don't go starving or lose any of your properties.

- Price-Rent Ratio: the most affordable to own and best place to live in is one with a low price-rent ratio. Paying less bills each month means that you save more and don't have to worry as much about paying a heavy monthly payment. In addition to this, renting for a place to stay can actually be quite feasible as well. This is because renting at a place frees you from worrying about many things and could be cheaper than paying bills for your own place.

- Down Payment Amount: if you pay at least 20% then you dont have to pay interest on a second mortage, reducing your total monthly payment and thus saving you money. Ideally you want to pay for everything at once as the higher your down payment the less interest you'll be paying.

- Savings: make sure you always leave aside some safe-keep money. It is always a wise thing to do in the case of a economic recession where money is hard to get. It can also prove useful in other situations and emergencies.

Being smart when buying properties such as real estate will ultimately serve you better in the future. Staying updated on topics such as housing prices and the economy could also alert you of changes to come which may play a large role in whether or not you want to sell/buy a home. A general smart decision would be to invest into building a concrete home as there are many benefits to it. Feel free to learn more about the benefits here.